Concepts

Please look at the concepts behind the Payouts feature so you can start using it easily!

Dispersing funds to third parties in Latin American markets is complex. It involves having connections with banks in each country and several legal considerations.

The current model has been a restriction for businesses that do not have local operations and want to pay third parties from other countries.

Bamboo Payouts offers you a payment system to allow mass transfers to third parties, using API or the dashboard, with updates on the status of transactions and notifications via e-mail to you and your third parties.

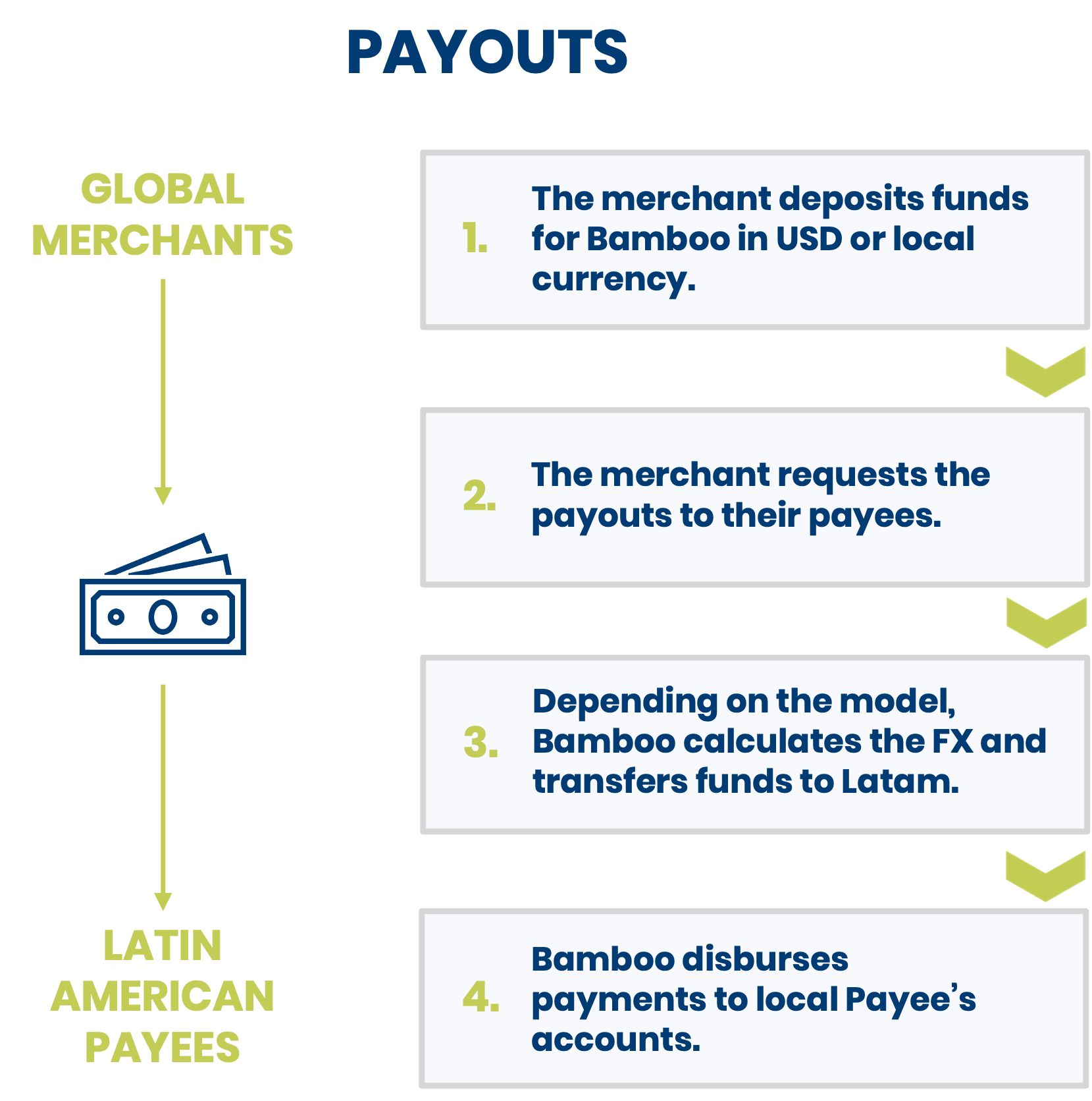

Using Bamboo Payouts, you can efficiently disburse the funds settled in your account to local beneficiary accounts. The following image briefly explains the process.

You can configure the Payout fee to be assumed by you or the payee. For more information about pricing and activation of the services, contact our local experts.

Bamboo Payouts offers four models that represent a combination of source and destination currencies.

| Country | ISO Code | Local Bank Transfer | Instant Transfer | Wallet | USD2L | L2L | USD2USD | L2L usd balance |

|---|---|---|---|---|---|---|---|---|

| Argentina | AR |  |  |  |  | |||

| Brazil | BR |  |  |  |  | |||

| Chile | CL |  |  |  |  | |||

| Colombia | CO |  |  |  |  |  |  | |

| Mexico | MX |  |  |  |  | |||

| Peru | PE |  |  |  |  |  |  | |

| Uruguay | UY |  |  |  |  |  | ||

| Bosnia and Herzegovina | BA |  |  |  | ||||

| Bulgaria | BG |  |  |  | ||||

| Costa Rica | CR |  |  |  | ||||

| Dominican Republic | DO |  |  |  | ||||

| Egypt | EG |  |  |  | ||||

| Guatemala | GT |  |  |  | ||||

| Israel | IL |  |  |  | ||||

| Nicaragua | NI |  |  |  | ||||

| Norway | NO |  |  |  | ||||

| Paraguay | PY |  |  |  | ||||

| Turkey | TR |  |  |  | ||||

| Bolivia | BO |  |  |  | ||||

| China | CN |  |  |  | ||||

| Ecuador | EC |  |  | |||||

| El Salvador | SV |  |  | |||||

| Honduras | HN |  |  |  | ||||

| Panama | PA |  |  |

For Peru, payouts in USD can only be made to banks, while payouts in Peruvian Soles (PEN) can be sent to both banks and wallets.

Payments in all countries are processed in real-time. There are no cut-off times, meaning transactions are executed immediately without delays.

When using the Payouts feature, consider the specific requirements for each payee’s country to avoid payment rejections.

0123456789012345678901.The Pix Key must follow the following specifications:

123.456.789-01 → 1234567890112.345.678/9012-34 → 12345678901234.+55. Example: +5521982485500.123e4567-e89b-12d3-a456-426655440000.DDDDDDDDDDDDDDDD where D is a digit.

Example: 1234567890123456.1234567890PaymentCode is a 6-letter field and must be one of the following codes.| Purpose of PaymentCode | Description |

|---|---|

CGODDR | Goods Trade: such as sell or purchase for goods, import or export of goods, procurement of goods, Letter of Credit or documentary collection related to goods trade, prepayment of goods, etc. |

CCTFDR | Capital Account: capital injection, capital reduction, capital payment, investment, shareholder loan, non-trade fund transfer, other capital payments as approved by relevant regulatory authorities. |

CSTRDR | Service Trade: such as public utility, rent, audit fee, hotel and accommodation fee, legal fee, advertising and promotion fee, copyright and license fee, service contract fee, design fee, research and development fee, registration fee, medical expenses, etc. |

CCDNDR | Current Account: donation to charity organizations. |

COCADR | Current Account: dividend payment, profit distribution, tax payment, scholarships. |

DDDDDDDDDDDDDDDDD where D is a digit.

Example: 12345678901234567.21790064060296600.If the bank account is for a bank (Type 2), it cannot exceed 20 characters.

Format: DDDDDDDDDDDDDDDDDDDD, where D is a digit.

Example: 12345678901234567890.

If the account is for a wallet (Type 3), the bank account field must be filled with the phone number,

without the + symbol, with a minimum length of 9 and a maximum of 15 numeric characters.

Example: 987654321 (minimum) - 123456789012345 (maximum).

BA39DDDDDDDDDDDDDDDDBA391234567890123456BGDDXXXXXXXXXXXXXXXXXXBG0012BG567890123456CRDDDDDDDDDDDDDDDDDDDDCR1234567890123456789012ABCD1234567890EGDDDDDDDDDDDDDDDDDDDDDDDDDEG123456789012345678901234567GTXXXXXXXXXXXXXXXXXXXXXXXXXXGT12KDYE78901234567890123456ILDDDDDDDDDDDDDDDDDDDDDIL123456789012345678901NICA1234567890NODDDDDDDDDDDNO1234567890123PAR1234567890TRDDDDDDDDDDDDDDDDDDDDDDTR1234567890123456789012| Bank name | Format | Length | Details | Example |

|---|---|---|---|---|

| BROU | YYYYYYYYYWWWWW | 14 |

| 12345678901234 |

| BHU | XXXYYZZZZV | 10 |

| 0123401234 |

| Citibank | XXXXXXXXXX | 10 | Filled with 0 on the left. The account number starts with 0, 1, or 5. | 0123456789 |

| Itau | XXXXXXX | 7 | Filled with 0 on the left. | 0123456 |

| Scotiabank | CCCCCCCCII | 10 |

| 0123456789 |

| Santander | XXXXXXXXXXXX | 12 | The account number filled with 0 on the left. | 012345678901 |

| Nación | XXXXXXXXXXXX | 12 | The account number filled with 0 on the left. | 012345678901 |

| BBVA | XXXXXXXXX | 9 | Account number without filling with 0 on the left only numeric digits. | 123456789 |

| HSBC | XXXXXXXXXX | 10 | Filled with 0 to the left. | 0123456789 |

| Heritage | XXXXXXXYY | 9 |

| 012345678 |

1234567890ABCD1234567890ABCD12345678901234567890ABCD1234567890Please look at the concepts behind the Payouts feature so you can start using it easily!

From when you request a payout to when your payee receives the money, the Payout follows a set of statuses. In this section, we give a brief explanation of these statuses.

The balance is the amount of money you have to process Payout transactions. We have three types of Balances in Bamboo Payout.

Before moving to a production environment, try our services and see how you can enable them to meet your business needs.