Purchase Preview

When a buyer performs a purchase, the amount of it can be modified for several reasons:

- Currency conversion (USD to local currency of the destination country)

- Commissions to be paid by the customer

- Taxes

- etc.

For example, in Argentina there are different taxes that affect the final amount and, as a consequence, the merchant cannot show the real amount that will be charged until the purchase is completed.

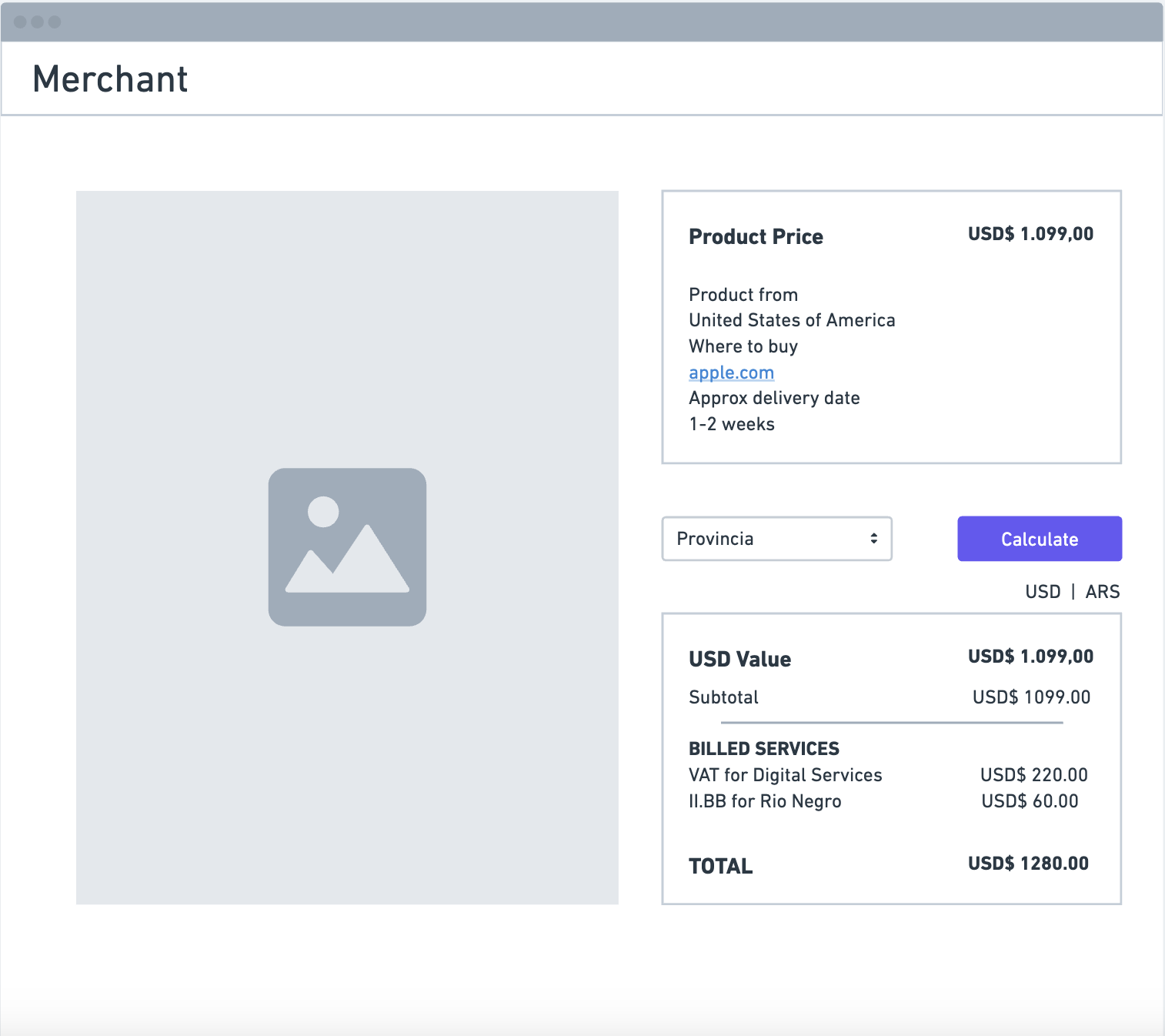

As a solution, we created a tool that allows the merchant to preview the amount that the customer will be charged so that they can inform it prior to executing the purchase.

The following example shows the way suggested to the merchants to display the preview in Argentina.

Request

To use the purchase preview, you must point to the following endpoint:

GET https://api.stage.bamboopayment.com/v1/api/purchase/preview

Remember to include your merchant’s Private Key in the request headers.

For more details, check our Authentication Guide.

Example of the request

{

"baseAmount": 100,

"currency": "USD",

"countryIso": "AR",

"paymentMediaId": 1,

"customer": {

"documentTypeId": 5,

"docNumber": "20222222223",

"state": "Buenos Aires",

"postalCode": "8512"

}

}Where:

| Parameter | Type | Mandatory? | Description |

|---|---|---|---|

baseAmount | integer | Yes | Amount to be paid before taxes. |

currency | string | Yes | Currency of the amount defined in baseAmount. |

countryIso | string | Yes | Country in ISO 3166-2 format. |

paymentMediaId | string | No | Payment Method identifier. This identifier can be obtained by consulting the Payment Methods by country section in the documentation. |

customer | Object | No* | Payer Information. *Required for Argentina. |

customer.documentTypeId | string | No | Payer Document Type. |

customer.docNumber | string | No | Payer document number. |

customer.state | string | No* | Payer state. *For Argentina, this field is mandatory and you must include the corresponding value using the table displayed in this section. |

customer.postalCode | string | No | Payer Zip Code. |

Response

Next, we show an example of the response to the request shown previously.

Example response

{

"Response": {

"Success": true,

"Data": {

"Date": "2023-03-30T20:35:39.3139535+00:00",

"Currency": "ARS",

"ExchangeRate": {

"Value": 402.090000,

"FromCurrencyIsoCode": "USD",

"ToCurrencyIsoCode": "ARS",

"TypeCode": "Median",

"Date": "2023-03-29T19:00:00"

},

"TotalAmount": 58865.98,

"TaxDetails": [

{

"TaxCode": "AR-VAT-DIGITAL",

"TaxName": "VAT",

"TaxAmount": 9650.16,

"TaxPercentage": 20.0,

"ResponsableType": "Merchant"

},

{

"TaxCode": "AR-INGR-BRUTOS",

"TaxName": "II.BB",

"TaxAmount": 965.016,

"TaxPercentage": 2.0,

"ResponsableType": "Merchant"

}

],

"AmountDetails": [

{

"CurrencyCode": "ARS",

"AmountCategoryCode": "EfEx",

"Amount": 8041.8,

"Sign": "Debit",

"ResponsableType": "Buyer"

},

{

"CurrencyCode": "ARS",

"AmountCategoryCode": "Gross",

"Amount": 40209,

"Sign": "Debit",

"ResponsableType": "Buyer"

}

]

}

},

"Errors": null

}The parameters in the response are the following:

| Parameter | Type | Description |

|---|---|---|

Success | boolean | Determines if the result of the operation was successful. |

Data.Date | date | Date the process was executed. |

Data.Currency | string | ISO code of the merchant’s currency. That is, the destination currency in the conversion. |

Data.ExchangeRate.value | number | Amount that the origin currency is equivalent to in the destination currency. |

Data.ExchangeRate.FromCurrencyIsoCode | string | ISO code of the origin currency. |

Data.ExchangeRate.ToCurrencyIsoCode | string | ISO code of the destination currency. |

Data.ExchangeRate.TypeCode | string | Not used. |

Data.ExchangeRate.Date | date | Date of the last update of the conversion rate. |

Data.TotalAmount | number | Total final amount of the purchase in local currency after applying the values that affect it (taxes, conversions, etc.). |

Data.TaxDetails | object | Contains the detail of the taxes that apply to the transaction. |

Data.AmountDetails | object | Contains the detail of the transaction subtotals. |

Object TaxDetails

Next, we explain the sub-parameters of the TaxDetails object.

| Parameter | Type | Description |

|---|---|---|

TaxCode | string | Tax code defined by Bamboo Payment. |

TaxName | string | Name of the tax that is applied. |

TaxAmount | number | Total value of the tax. |

TaxPercentage | number | Percentage corresponding to the tax. |

ResponsibleType | string | Indicates whether the party responsible for the tax is the merchant (Merchant) or the payer (Buyer). |

Note

In the example of the request, two taxes are specified for Argentina: VAT corresponding to the VAT of Digital Services and II.BB corresponding to the Gross Income tax.

Object AmountDetails

Next, we explain the sub-parameters of the AmountDetails object.

| Parameter | Type | Description |

|---|---|---|

CurrencyCode | string | ISO code of the currency of the amount. |

AmountCategoryCode | string | Amount category. |

Amount | number | Value of the amount. |

Sign | string | Indicates if the amount is a debit or credit movement. |

ResponsibleType | string | Indicates whether the party responsible for the tax is the merchant (Merchant) or the payer (Buyer). |